PRESS RELEASE

AMC Global and OpinionRoute have release a second wave of research examining shopping behavior during continuing inflation in the marketplace

AMC Global, an international custom market research firm specializing in launch strategies and brand tracking, and OpinionRoute, a leader in insights process management, have released the latest wave of their consumer behavior study which continues the examination of ongoing inflation and shopping behaviors.

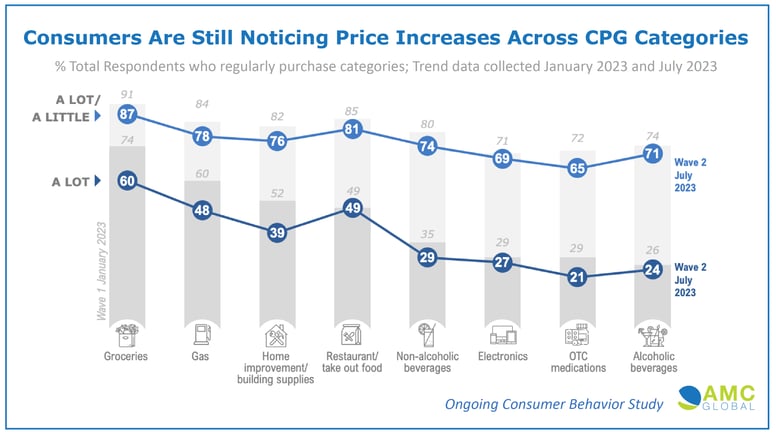

The trend data in the latest study, “CPG Price Increases, Shopper Perceptions & Behaviors,” builds on the previous data on inflation impacts collected in January 2023. The new findings show significant drops in perceived price increases across multiple consumer packaged goods (CPG) categories. As shown in the previous study, consumers are still reducing purchases and they are continuing to choose generics for OTC medicines to save money in the face of price increases.

You can view a the complete representation of the data here, or click the callout below.

Key findings from the latest study:

- The latest study wave shows a decrease in consumer perception of price increases in various categories like groceries (87%, down 4 points from study conducted in January 2023), gas (78%, down 6 points), home improvement and building supplies (76%, down 6 points), OTC medications (65%, down 7 points) and non-alcoholic beverages (74%, down 6 points).

- The largest gap in consumer perception of price increases is for eggs at 77%, down 23 points.

- More than half of consumers are purchasing generic OTC pain medications as a result of price increases.

- While most are just purchasing less often, other behaviors resulting from price increases also remain largely similar between the two waves of the study with 28% of shoppers buying on sale/with coupon, 25% choosing a cheaper brand, 13% buying in bulk, 12% buying another type of product instead and 11% shopping at a different retailer than usual.

A complete representation of the “CPG Price Increases, Shopper Perceptions & Behaviors” study can be found here. These insights were collected Thursday, July 29 – Monday, July 31 and were compared to data collected Friday, January 20 – Sunday, January 22, 2023, each among a general population of n=1001 U.S. consumers age 21+.

Further results will be released regarding attitudes about finances and what consumers hold responsible for price increases. The findings from this ongoing study are designed to help clients and industry leaders navigate quickly changing consumer behavior. Contact us for more information.